Eitc Income Limit 2025

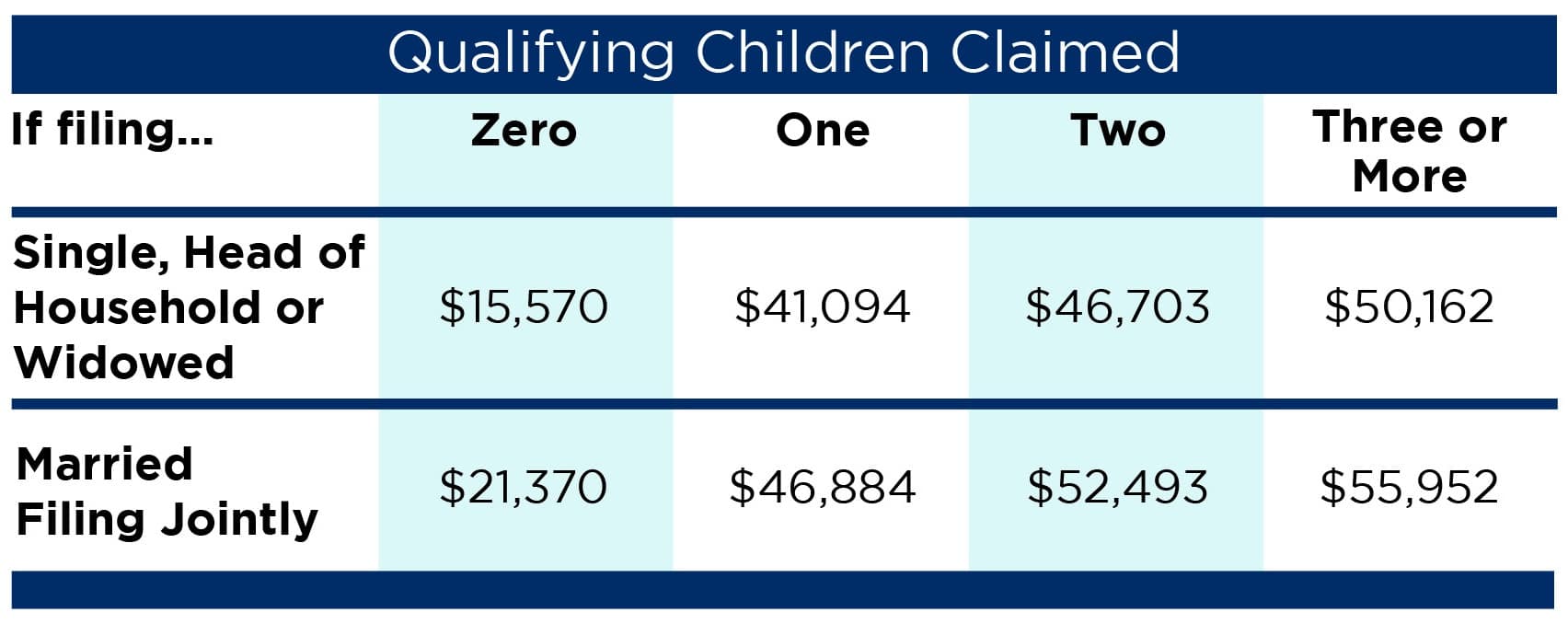

Eitc Income Limit 2025. For tax year 2025 and 2025, the maximum income limit for single filers will be $56,838 with three dependents. For the 2025 tax year (taxes filed in 2025), the earned income credit will range from $632 to $7,830, depending on your filing.

In some cases, the eitc can be as much as $7,830 for families with three or more children, but any money saved or received is good money.

600 Earned Tax Credit 2025 Know Limit & EITC Refunds Date, [updated with 2025 irs adjustments] below are the latest earned income tax credit (eitc) tables. How the irs is adjusting eitc and child tax credit.

Earned Tax Credit City of Detroit, For tax year 2025, the child tax credit is $2,000 per child, age 16 or younger. Use the eitc tables to.

2025 Tax Bracket Changes and IRS Annual Inflation Adjustments, New york is another state that has reduced tax rates for some income groups: You must meet all four of these rules, in addition to the rules in chapters 1 and 4, to qualify for the eic without a qualifying.

Earned Credit Limitation Tax Reform Changes Ohio CPA, Use the eitc tables to. The law took effect on.

How much will I get back for earned credit? Leia aqui How much, Find out how to claim the eitc without a qualifying child. That new revenue would help pay.

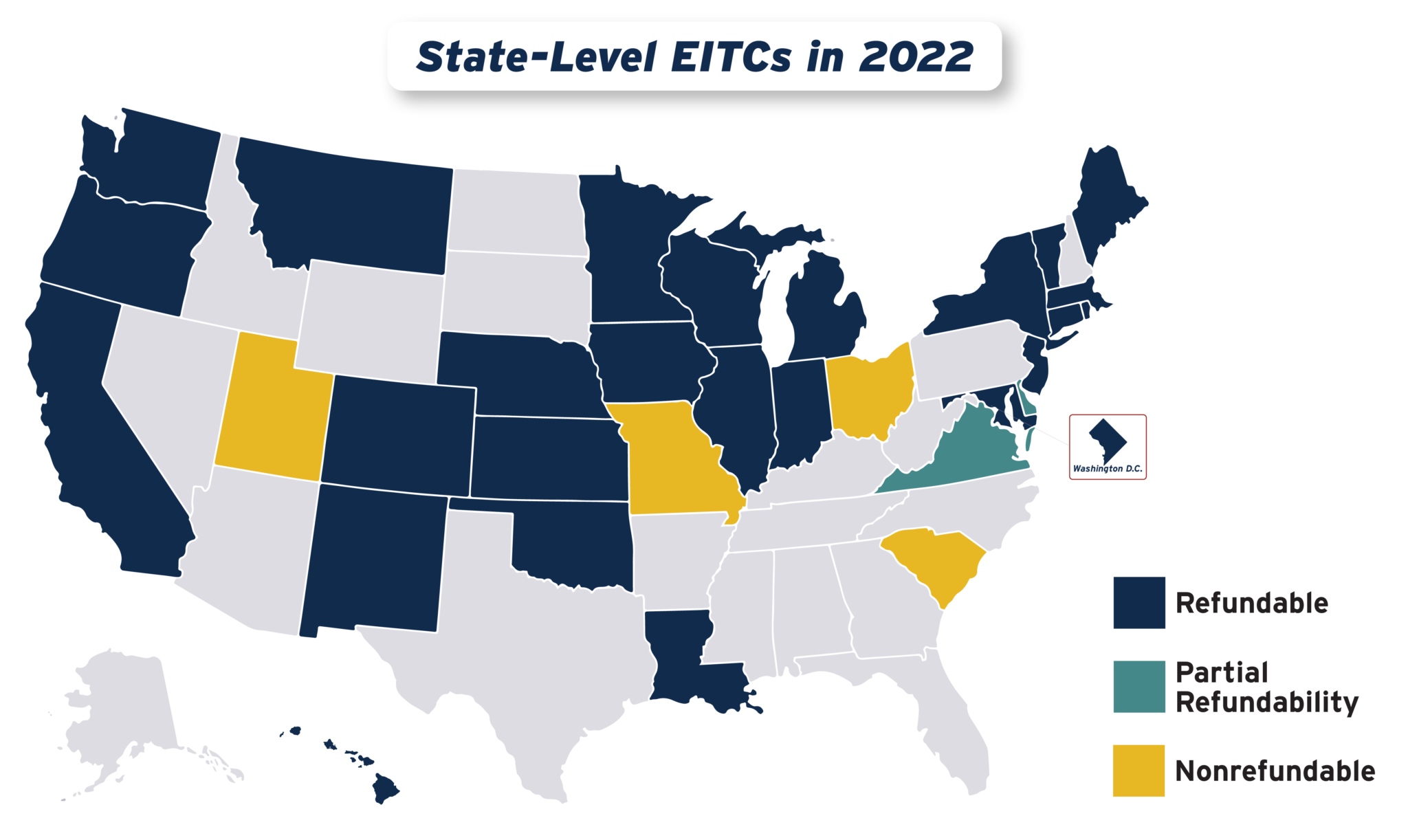

Boosting and Improving Tax Equity with State Earned Tax, Eligibility for eitc investment income limit. [updated with 2025 irs adjustments] below are the latest earned income tax credit (eitc) tables.

Earned Tax Credit? (EITC) Definition TaxEDU, If passed by the senate intact, the bill called the tax relief for american families and workers act of 2025 would increase the maximum. For the 2025 tax year, you don't qualify for the earned income credit if your earned income exceeds the limits in the earned income credit table above.

Free Tax Prep Capital Area UW, To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years. For 2025, the income limits for the eitc will be determined by the irs and will be adjusted for inflation.

Earned Credit (EIC) Calculator 2025 2025, [updated with 2025 irs adjustments] below are the latest earned income tax credit (eitc) tables. How the irs is adjusting eitc and child tax credit.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The law took effect on. The expanded michigan eitc is retroactive to the 2025 tax year (last tax season) but the law change did not take effect when it was passed.

In 2025, the earned income amounts (amounts of earned income at or above which the maximum amount of.